You need a budget credit card payments free#

It will free up more money for you to use on paying off other debts and getting your obligations under control. We will talk with your creditors about your debt work to get you a payment you can live with. We can help you identify ways to lower your debt and we can work on a plan to consolidate your debt through a debt negotiation plan.

You need a budget credit card payments how to#

We can show you how to put together your own budget and get your monthly obligations under control. But we want you to remember that you are not alone in your attempts to get your debt under control. Once you have your budget worksheet in place, then you can start to address paying off your debt. To help maintain your payment schedule, you should carefully plan paying bills around the days that you get paid. It is important to try and get ahead of your bills because you do not always get paid on days when it is convenient for your bills schedule.

You need to account for every source of income that you have and develop a calendar of when you get paid to fit into your budget. You should set aside five to 10 percent of your income each month to handle those expenses. There will also be one-time expenses such as birthday presents or flowers for Mother’s Day. It does not matter how much you put away as long as you save as much as you can. You will also need to create a budget item for money to put into a savings account each time you get paid. Keep a log of what you spend, and then, after two months, take the average of each category and use those as budget items in your worksheet.

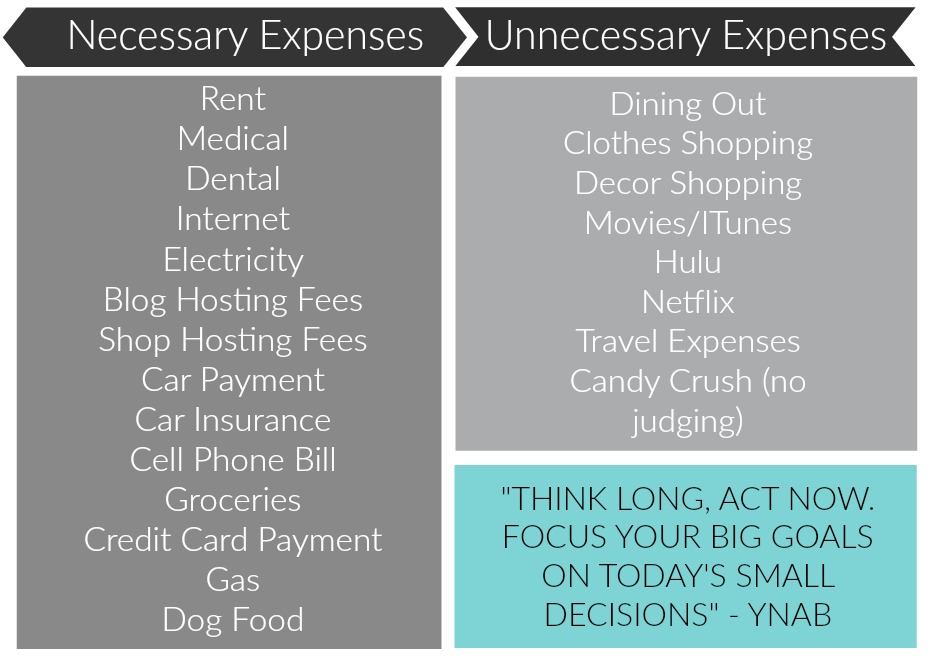

At this point, you are only concerned with the recurring expenses that you pay every month. Your monthly expenses are things like gas for the car, money spent on going to the movies and money spent on groceries. This will free up money quicker and give you more to apply towards your larger debt. If you have two cards with the same interest rate, then go after the one with the smaller balance first. It is always a good idea to pay off the cards with the highest interest rates first because those tend to build up debt quicker. When you have extra money, you apply it to your credit card bills based on the balance due and the interest rate. This is to preserve your credit score and prevent collection actions from being taken against you.Īs you put your budget together, you will work to create extra money each month to pay off your debt. It is also important that you pay no less than your monthly minimum payments each month as well. You want to make certain that you pay your bills on time every month to preserve your credit score. The payment due dates, monthly minimum payments, interest rates and remaining balances are the most important pieces of information on your bills. Your bills come to you in the mail every month and will have all of the information you need to get yourself organized. Once you have your format, then you can start plugging in numbers. You can create your own computer worksheet, or you can buy a budget worksheet program that is already set up for you. But the most efficient way to create a useful budget sheet is by using a computer program. You can create a budget worksheet using a pen and paper if you choose.

0 kommentar(er)

0 kommentar(er)